10 Easy Facts About Mileagewise - Reconstructing Mileage Logs Explained

The Basic Principles Of Mileagewise - Reconstructing Mileage Logs

Table of ContentsExcitement About Mileagewise - Reconstructing Mileage LogsSome Known Details About Mileagewise - Reconstructing Mileage Logs Mileagewise - Reconstructing Mileage Logs - An OverviewThe 15-Second Trick For Mileagewise - Reconstructing Mileage LogsEverything about Mileagewise - Reconstructing Mileage LogsThe 4-Minute Rule for Mileagewise - Reconstructing Mileage LogsOur Mileagewise - Reconstructing Mileage Logs Ideas

Timeero's Shortest Distance function suggests the shortest driving route to your staff members' location. This function boosts productivity and contributes to set you back savings, making it a vital asset for businesses with a mobile workforce.Such a technique to reporting and conformity simplifies the frequently intricate task of taking care of mileage costs. There are many advantages connected with making use of Timeero to monitor mileage. Allow's take a look at several of the app's most noteworthy attributes. With a relied on gas mileage monitoring device, like Timeero there is no demand to worry regarding unintentionally leaving out a day or item of information on timesheets when tax time comes.

How Mileagewise - Reconstructing Mileage Logs can Save You Time, Stress, and Money.

These extra confirmation measures will maintain the IRS from having a reason to object your mileage records. With precise gas mileage tracking innovation, your workers don't have to make rough gas mileage estimates or also stress about gas mileage expenditure monitoring.

If a staff member drove 20,000 miles and 10,000 miles are business-related, you can write off 50% of all vehicle costs (mileage tracker). You will need to proceed tracking gas mileage for job even if you're making use of the real expense method. Keeping mileage documents is the only way to different business and personal miles and provide the evidence to the internal revenue service

The majority of gas mileage trackers allow you log your trips manually while determining the range and compensation quantities for you. Numerous likewise come with real-time journey monitoring - you need to begin the application at the beginning of your journey and quit it when you reach your final location. These applications log your start and end addresses, and time stamps, along with the overall distance and repayment amount.

The 2-Minute Rule for Mileagewise - Reconstructing Mileage Logs

This includes prices such as gas, maintenance, insurance policy, and the vehicle's depreciation. For these expenses to be thought about insurance deductible, the automobile must be utilized for service purposes.

How Mileagewise - Reconstructing Mileage Logs can Save You Time, Stress, and Money.

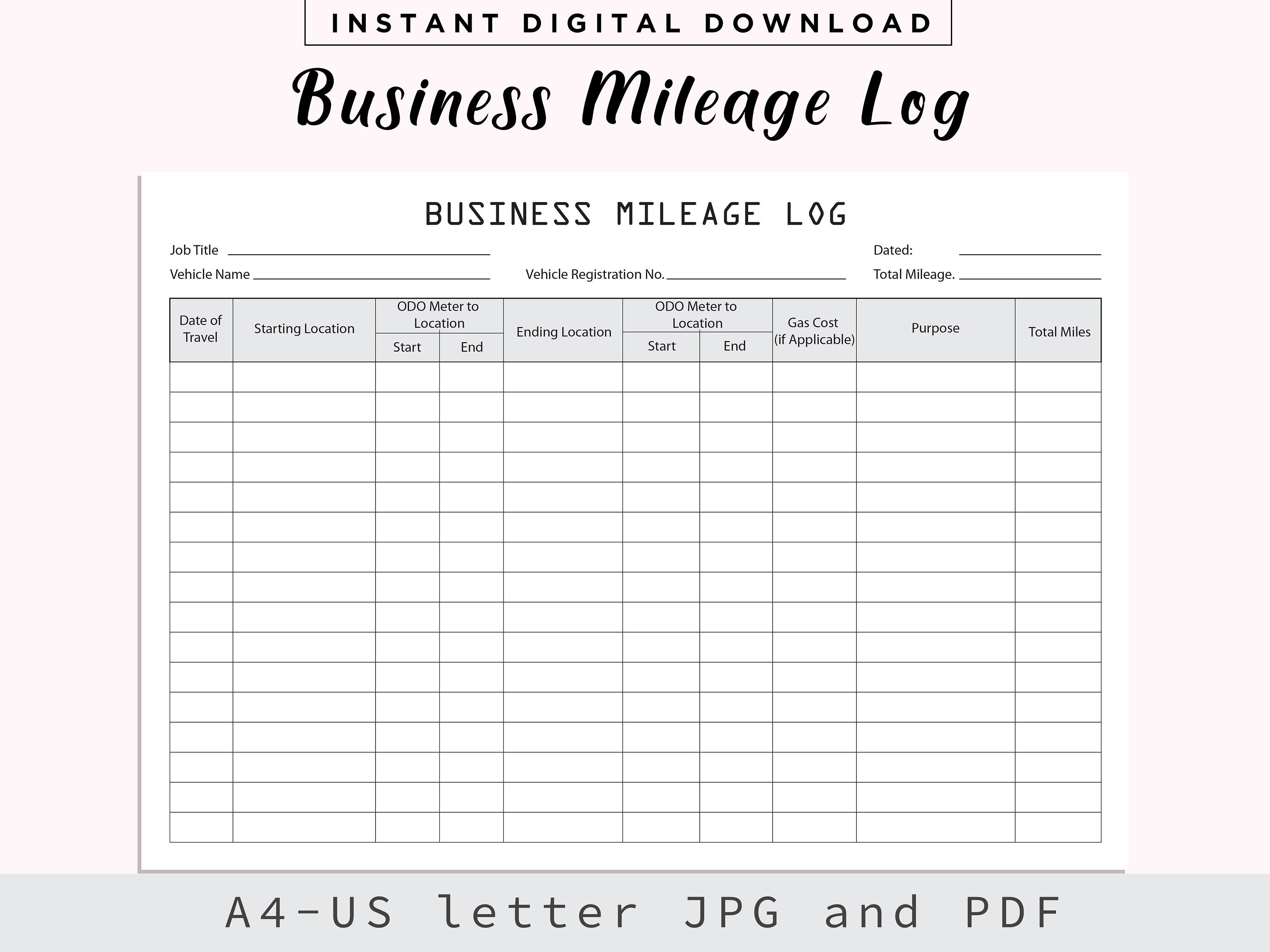

In between, vigilantly track all your business journeys noting down the starting and ending analyses. For each journey, record the area and business purpose.

This consists of the total service gas mileage and complete gas mileage build-up for the year (organization + individual), journey's date, destination, and purpose. It's vital to videotape activities quickly and keep a simultaneous driving log detailing day, miles driven, and company purpose. Below's exactly how you can boost record-keeping for audit functions: Start with making sure a careful gas mileage log for all business-related traveling.

The smart Trick of Mileagewise - Reconstructing Mileage Logs That Nobody is Talking About

The real costs approach is a different to the typical mileage price approach. Rather than determining your reduction based upon a predetermined price per mile, the actual expenses method permits you to deduct the actual costs related to utilizing your vehicle for service functions - mile tracker app. These expenses include gas, upkeep, repair services, insurance, devaluation, and other related expenditures

Those with considerable vehicle-related expenditures or one-of-a-kind conditions might profit from the actual costs technique. Inevitably, your selected technique should straighten with your details economic objectives and tax scenario.

Not known Factual Statements About Mileagewise - Reconstructing Mileage Logs

(https://mi1eagewise.bandcamp.com/album/mileagewise-reconstructing-mileage-logs)Whenever you use your automobile for organization trips, tape the miles took a trip. At the end of the year, again write the odometer analysis. Compute your total company miles by utilizing your beginning and end odometer readings, and your videotaped service miles. Accurately tracking your precise mileage for service journeys aids in confirming your tax reduction, particularly if you select the Standard Gas mileage technique.

Maintaining track of your mileage by hand can call for persistance, yet remember, it could conserve you cash on your tax obligations. Tape the total gas mileage driven.

4 Easy Facts About Mileagewise - Reconstructing Mileage Logs Described

And now virtually everybody makes use of GPS to get around. That indicates nearly everyone can be tracked as they go concerning their service.